Tax season isn’t usually something business owners look forward to. But what if you could make one smart investment this year and turn it into a serious win? Section 179 for self-storage can help.

If you run a self-storage facility, there’s a section of the tax code you should know: Section 179. It’s not just an accounting loophole. It’s a chance to save money, grow your business, and set yourself up for long-term success. Here’s what it means, how it works, and why relocatable self-storage units might be the most practical and profitable purchase you make in 2025.

1. What is Business Equipment—and Why it Matters

Section 179 for self-storage lets you deduct the full purchase price of qualifying equipment in the year you put it to work. So, instead of spreading depreciation over five or more years, you get the full benefit right away. This applies to all kinds of everyday business equipment—trucks, trailers, office furniture, computers, and yes, even relocatable storage units.

That’s a big deal, especially in an industry like self-storage where every square foot can mean new income. Being able to write off equipment in the same year you buy it frees up cash to re-invest where it matters most.

2. Why a Boxwell Unit Makes Sense

When facility owners think about expansion, one solution is to build new, permanent structures. But that route comes with high costs, long timelines, and a long list of headaches. This includes permits, zoning, inspections, weather delays, and construction loans. And once it’s built, it’s fixed. You’re locked into the layout and location.

Relocatable storage units offer a better path forward. Simply put, they’re considered equipment, not real estate, which means:

- No lengthy permitting or zoning processes

- No construction delays or major site disruption

- Units can be placed exactly where they’re needed—and moved as your site evolves

Even more importantly, you can start earning income fast. Instead of waiting months (or longer) for a new building to be approved and constructed, relocatable units can be delivered, installed, and rented out quickly. They’re a flexible solution that adds revenue-generating space without the overhead of a permanent build.

And because they qualify for the Section 179 deduction, you can write off the entire cost in the year you place them in service—which you can’t do with a new building. It’s not just a faster way to grow. It’s a smarter way to scale.

3. Why Now is the Time to Act

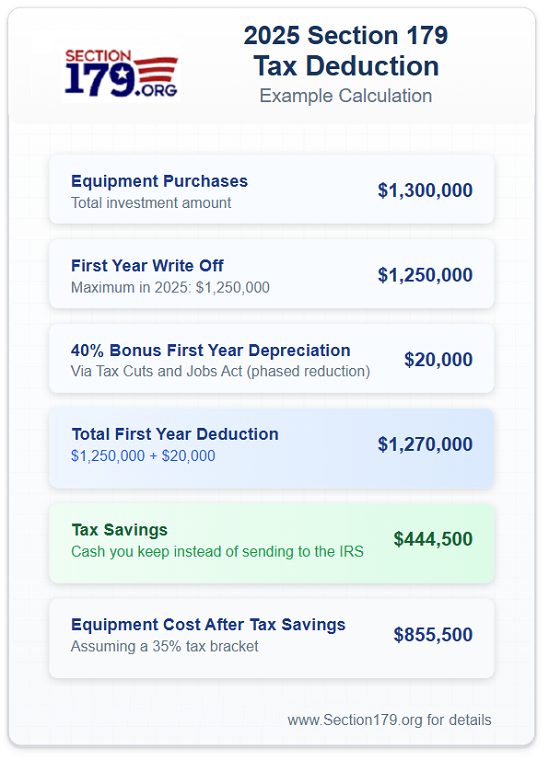

In 2025, Section 179 lets you deduct up to $1.22 million in qualifying equipment purchases—everything from storage containers to forklifts. The deduction starts to phase out once you hit $3.05 million in total spending, but here’s the good news: even if you go over that amount, you can still take advantage of 60% bonus depreciation on the rest. ~Section179.org

That means there’s real flexibility. Whether you’re a small operator making your first investment or a larger facility planning a big expansion.

If you plan ahead and order units now, you’ll have your relocatable self-storage units on site and generating income by the time tax season rolls around. That means you get the deduction this year, not years from now. It’s a smart way to grow your business while reducing your tax burden. That’s what we mean when we say pay yourself first—use your money in ways that give something back.

Section 179 for Self-Storage – Why Relocatable Units Qualify

Unlike permanent storage structures, relocatable units are movable, don’t require zoning headaches, and can be financed like any other business equipment. They’re fast to deploy and flexible enough to adapt with your business.

Permanent construction takes time and red tape. Relocatable units are fast, cost-effective, and easier to finance. And now, with the tax savings, they’re even easier to justify. As Inside Self-Storage puts it, “Just a little planning could give you access to previously undiscovered capital.” That capital could be in your next row of units.

What to Do Next

Boxwell’s current lead time is 12–14 weeks. Financing and customization are available. That gives you just the right window to have your units in place this year. And then you take the full write-off when you file your 2025 taxes.

Order your units. Start earning money. And when tax time rolls around, your future self will thank you. For more info, talk to your tax professional. Or visit section179.org to explore the deduction in more detail.

Boxwell designs, manufactures, and installs industry-leading storage solutions. Our lineup includes relocatable self-storage units, portable containers, hallway systems, and roll up doors. Every product is fully customizable and built to last—trusted by companies across the United States, Canada, Europe, the United Kingdom, Australia, the Middle East, Asia, and beyond.

Boxwell is Built For Your Success. From the start, our mission has been simple: create the best B2B storage products and back them with outstanding customer support. Our clients gain access to dedicated Account Managers, design and installation services, and extensive product warranties.

We are here to help. Contact Boxwell today via our email, sales@boxwell.co, or call 303-317-5850.